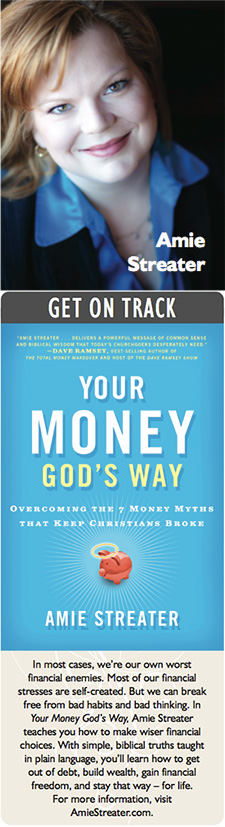

Amie Streater is a financial expert, award-winning journalist, and the author of Your Money God’s Way. In the past three years alone, she has helped people pay off over $6 million in debt. To get you on the right financial track, our editors asked her a few important questions.

Amie Streater is a financial expert, award-winning journalist, and the author of Your Money God’s Way. In the past three years alone, she has helped people pay off over $6 million in debt. To get you on the right financial track, our editors asked her a few important questions.

Question: How much debt is too much debt?

Amie: Any debt is too much debt. While you're not a bad person if you have debt, the Bible clearly states that being debt free is a blessing, and something to strive for. In the Message Bible, Proverbs 22:7 says, “The poor are always ruled over by the rich, so don’t borrow and put yourself under their power.”

Question: What can be considered good debt versus bad debt?

Amie: The Bible doesn't distinguish between good debt and bad debt – therefore, neither do I. However, I do distinguish between debt, stupid debt, and really stupid debt. Borrowing money to buy a home isn't "good" debt, but it is understandable debt. In ideal circumstances, a home is an appreciable asset. And everyone needs a place to live. Borrowing sensibly to buy a home you can afford (when the payments are less than 25 percent of your take-home pay, and you put at least 20 percent down in cash) will most likely yield good results. But, of course, not always. On the other hand, borrowing to buy a home you can’t afford (when the payments are more than 30 percent of your take-home pay, and you put less than 20 percent down in cash) is stupid debt. Also, using "creative financing" (such as an adjustable rate loan – or other nonsense to buy a home you can't afford) is really stupid debt.

Furthermore, if you simply can’t afford to purchase a car with cash, don't borrow more than you can easily pay off in a year or two. And my rule of thumb for financing a car is “keep the price below 50 percent of your annual pay.” If you make $30,000 a year and you're driving a $40,000 car, you're on your way to the poor house. Plus, if you can’t afford a new car, there are a lot of used cars in great condition. You just have to shop wisely.

Question: What strategies can be used to crawl out of debt, even on a limited income?

Amie: First and foremost, pray. Second, face the problem. This seems obvious, but it is really important to write down your total amount of debt and face it head-on. At our worst point, my husband and I had over $100,000 in credit card debt! Saying that out loud a few times was sobering. In addition, repeating that number out loud helped me say “no” to foolish spending options. I never defined myself by my debt, and I had to forgive myself for being so stupid. But I also had to acknowledge (daily) that there was a big beast in the backyard that we created, and we had to slay it through hard work and sacrifice. Telling yourself, "It's not so bad” – or not even knowing how much debt you have – will only make the beast grow larger day by day.

Third, get some help! However, be really careful. Most places that offer "help" are really there to rip you off. Avoid credit counseling, debt consolidators, and those 1-800 numbers you see on late-night television. Credit counselors charge you $50 or more a month to dole out your payments (something you can do yourself). And debt consolidators just shuffle the debt around (and add to it), which doesn't solve anything. Therefore, find some friends or people in your church who are really, really good with their money. I’m not referring to your friends with multi-level marketing businesses, or your friends with big “money making” ideas. Speak to your friends with cash in the bank, paid-for cars, excellent credit, and debt-free lifestyles. Lay everything out on the table, and then do what they tell you to do. Don't argue and explain why you have to keep the fancy car. Sell the car, and get out of debt. If you can't find someone in your church, and all your friends are as broke as you are, go to DaveRamsey.com. That website will help you search for a financial coach in your area. There are many Dave Ramsey coaches who don't charge anything for their services. It may take some work to find them, but you're assured sensible, biblical advice. And if I can help you in any way, visit AmieStreater.com.